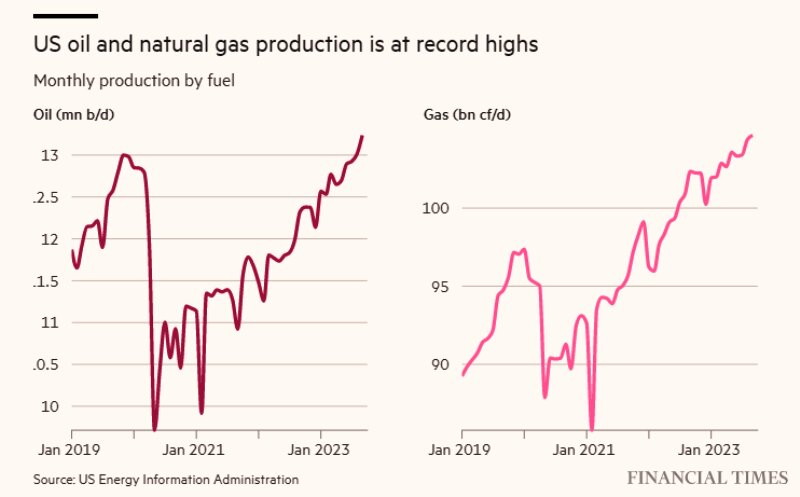

A significant burden looms over the global oil markets as prices tumble to five-month lows, attributed to a surge in US oil supply. In September, American crude oil production hit an unprecedented 13.2 million barrels a day, surpassing all other countries and constituting approximately one-eighth of the world’s total output. This surpassing of official forecasts raises doubts about claims of a constricted US oil industry due to Wall Street or environmental regulations.

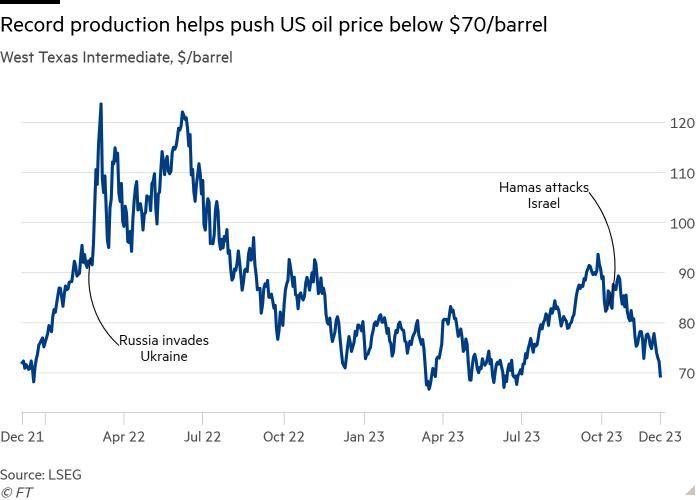

The excessive volumes pose challenges for the OPEC+ oil cartel, which recently agreed to intensify cuts to its members’ output to stabilize declining prices. Additionally, the newfound supplies are unsettling for the Biden administration as US officials advocate for the phasing out fossil fuels at the UN climate talks in Dubai. On Wednesday, West Texas Intermediate crude fell below $70 a barrel for the first time since July, a development attributed, in part, to the unexpectedly high production from US shale fields.

Bob McNally, president of Rapidan Energy Group, emphasized, ‘US supply was probably the biggest surprise of the surprises,’ citing it as the ‘main reason’ markets have not tightened as anticipated. This situation sharply contrasts with three years ago when the COVID-19 pandemic triggered a plunge in oil prices, leading drilling companies to idle rigs and lay off workers.

In the aftermath, concerns arose as Wall Street prioritized financial returns over growth, coupled with apprehensions about the availability of prime drilling acreage. President Joe Biden’s aggressive stance towards the sector further fueled worries, leading some to speculate that the industry’s heyday might be a thing of the past. Despite these concerns, the US is driving 80 percent of the global oil supply expansion this year, as the International Energy Agency reported. The US Energy Information Administration estimates a growth of 850,000 barrels per day, a pace slower than the earlier shale revolution but exceeding analysts’ expectations.

The Permian Basin in Texas and New Mexico, the most prolific oilfield in North America, has witnessed the most robust growth, marked by a flurry of corporate dealmaking indicating future production gains. In the Permian, new wells have significantly increased average oil production per drilling rig to 1,319 barrels per day, starkly contrasting the figure of about 183 barrels per day a decade ago. Significant players like Devon Energy, EOG Resources, and ExxonMobil all reported Permian output growth in the third quarter compared to the previous year. Scott Sheffield, CEO of Pioneer Natural Resources, the Permian’s largest producer, expressed being “very surprised” by the growth, nearly double what he had estimated a year ago. Sheffield suggests reaching 15 million barrels daily within five years, referring to total US volumes.

Advancements in technology and increased efficiencies empower drillers to extract more from the ground, building on breakthroughs like horizontal drilling and hydraulic fracturing that sparked the shale revolution in the mid-2000s. These innovations enable drillers to bore horizontally through rock for more than three miles. Eimear Bonner, Chevron’s Chief Technology Officer, notes that shale is still “relatively early in its life” regarding technological advances that could boost productivity. She emphasizes ongoing efforts to drill longer laterals, improve efficiency, and gather more data for better decisions, expressing optimism about further advancements.

US oil supermajors are increasing investment after the austerity that followed the 2020 oil price crash. This renewed focus on investment indicates a positive outlook for the industry’s future.

Exxon has recently sealed a deal to acquire Pioneer for a whopping $60 billion, while Chevron is investing $53 billion in Hess, both banking on a robust future demand for fossil fuels. Following the downturn induced by Covid-19, the price surge triggered by Russia’s invasion of Ukraine has spurred producers to intensify drilling efforts. In September, natural gas production in the US reached a record high, exceeding 125 billion cubic feet daily.

This rebound in oil and gas production has prompted accusations of hypocrisy directed at the Biden administration. Despite advocating for a shift away from fossil fuels at the COP28 climate summit in Dubai and initially attempting to freeze new drilling on public lands and restrict lease sales in the Gulf of Mexico, oil production on federal lands and waters has reached unprecedented levels during President Biden’s tenure.

Critics, such as Raena Garcia, senior fossil fuels campaigner at Friends of the Earth, argue that positioning the US as a climate champion at COP, is a facade given its status as the world’s largest oil and gas producer. However, industry executives acknowledge a perceptible shift in the administration’s tone, which they attribute to increased pragmatism following the prominence of energy security concerns amid the Ukraine conflict.

Exxon’s CEO, Darren Woods, attending the UN climate summit for the first time, asserts that the Biden administration is committed to reducing emissions. Yet, he emphasizes the recognition that a balance must be struck to meet immediate needs for home heating, cooling, and affordable transportation, necessitating the functioning of the existing energy system.

The top US climate diplomat, John Kerry affirms that the administration has committed to the “phaseout of unabated fossil fuels” and supported a G7 measure targeting net-zero energy systems by 2050. He attributes the increased production to geopolitical events, such as the Ukraine conflict and the aftermath of Covid, citing efforts to assist regions affected by Russia’s disruption of gas supplies

.

As seen in previous downturns, a sharp decline in oil prices could lead US producers to scale back, ultimately forcing output lower. Harold Hamm, chair of Continental Resources, the largest private oil producer in the US, acknowledges the uncertainty, stating, “We’ll just have to see how it plays out.” However, he notes that, so far, there is a strong determination and commitment among producers to continue their current trajectory.