The crypto market has been on a tear since the start of 2024, gaining 35% in value and approaching its all-time high of $2.8 trillion. However, some investors may be worried that the rally is losing steam and that it is too late to enter the market.

Bitcoin’s MVRV Ratio Shows Room for Growth

Bitcoin is the largest and most influential cryptocurrency in the market, accounting for about half of the total market value. Therefore, analyzing Bitcoin’s current position can give us a clue about the overall state of the market. One useful metric to look at is the Market Value to Realized Value (MVRV) ratio, which was developed by analysts David Puell and Murad Muhmudov.

The MVRV ratio compares Bitcoin’s market value, which is the product of its circulating supply and current price, to its realized value, which is the sum of the prices of each Bitcoin the last time they were moved. The MVRV ratio can provide a more nuanced insight into the market sentiment, as it reflects the average profit or loss of the holders.

Historically, the MVRV ratio has been a reliable indicator of when the market has reached a peak or a bottom. When the ratio is high, it means that most holders are in profit and may be tempted to sell, creating downward pressure on the price. When the ratio is low, it means that most holders are in loss and may be reluctant to sell, creating upward pressure on the price. As you can see from the chart below, the MVRV ratio is currently at 2.3, which is far from the levels of around 3.5 that have marked the end of previous bull markets. This suggests that there is still room for growth and that Bitcoin’s price has not reached its local maximum.

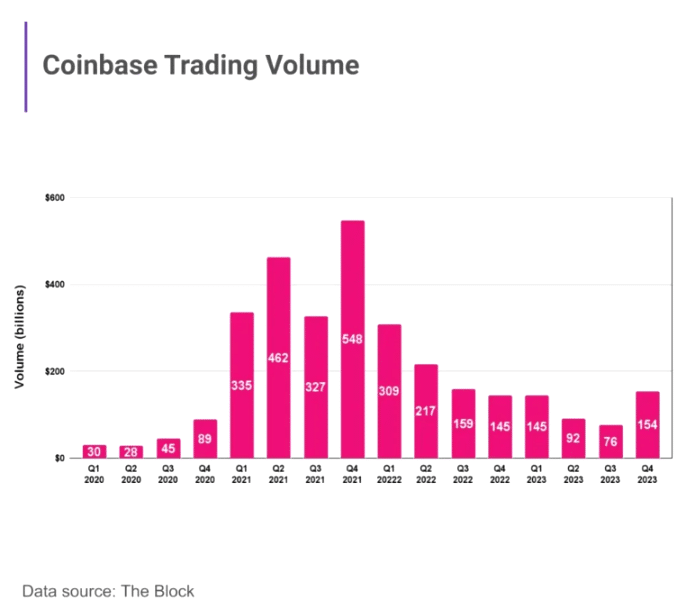

Coinbase Trading Volume Indicates Low Contribution

Coinbase Global is one of the most popular and trusted crypto platforms in the world, with over 73 million verified users and 9,000 institutional customers. Therefore, the trading volume on Coinbase can serve as a proxy for the level of participation and interest in the crypto market. As you can see from the graph below, the trading volume on Coinbase is still relatively low compared to the last bull market in 2021, when it reached more than $548 billion in the fourth quarter alone. As of the latest earnings report, the total trading volume on Coinbase was only $154 billion, which is similar to the levels seen during the crypto winter of 2022 and 2023.

This indicates that many investors have not yet returned to the crypto market and that there is still a lot of pent-up demand waiting to be unleashed. Once the market sentiment improves and more investors join the fray, the trading volume on Coinbase and other platforms will likely increase significantly, driving the prices of cryptocurrencies higher. Moreover, since crypto has a history of breaking new records with each bull cycle, it is possible that the trading volume in this cycle will surpass the previous highs, signaling a strong and sustained rally.

Watching the DeFi

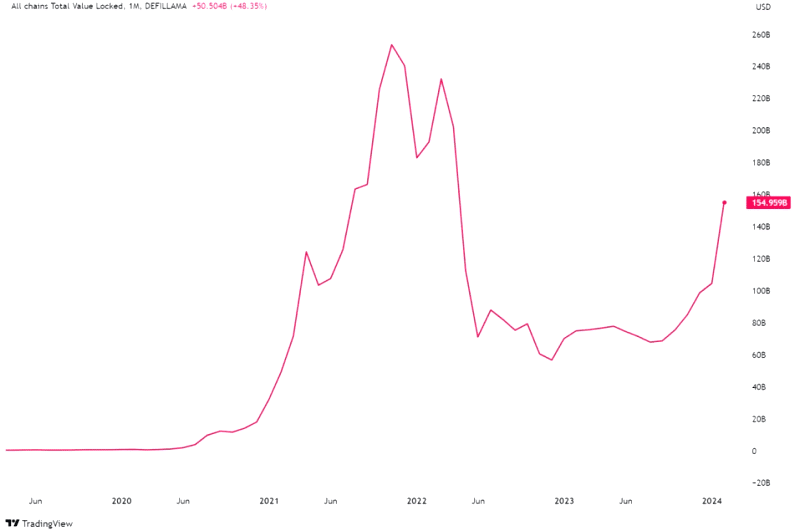

Decentralized finance (DeFi), which is a fast-growing and exciting field of crypto and blockchain innovation. DeFi consists of various applications that use digital assets, such as NFTs, stablecoins, and lending platforms, to create new possibilities for finance. DeFi is not limited to one blockchain, but rather spans across multiple networks.

Ethereum is the most dominant one, but many others are competing for a slice of the pie. One way to gauge the health and size of the DeFi market is to look at its total value, which reflects the amount of money locked in DeFi applications. Right now, the DeFi market is worth about $85 billion, which is impressive, but still far from its peak of over $175 billion in November 2021.

If we compare the DeFi market value to the trading volumes, we can see that there is still room for growth, as DeFi has a lot of potential to disrupt and improve the traditional financial system. Therefore, we should not assume that the crypto bull market is over until DeFi reaches new heights.