The commercial real estate market is facing a crisis as many apartment housing loans turn sour amid the pandemic. Borrowers who took out loans during the peak of the crisis are now struggling to repay them as interest rates rise and occupancy rates fall. This puts more than $67 billion of apartment complexes at risk of default or foreclosure. The situation is worsening the already fragile state of the commercial property market, which has been hit hard by the decline of office spaces.

Arbor Realty Trust Inc. in Trouble

One of the lenders feeling the pain is Arbor Realty Trust Inc., which specializes in packaging its floating rate loans into commercial real estate CLOs (collateralized loan obligations).

This financing strategy became very popular during the pandemic, allowing lenders to sell off the safer parts of the loans to investors and keep the riskier parts for themselves.

However, this strategy backfired when the share of loans in Arbor’s CLOs that failed to make a scheduled payment more than doubled in the fourth quarter of 2023, according to preliminary data compiled by Banco Santander SA. About 16.5% of Arbor’s unpaid loans by value were past due in December, according to the data, about 2.5 times the level for the broader CRE CLO market.

Mary Beth Fisher, a senior fixed income strategist at Santander, said in a note last month that the overall market for CRE CLOs deteriorated throughout 2023, with stress and delinquency rates rising sharply in the year’s final two months. She said the trend is likely to continue through the middle of 2024.

Paul Elenio, chief financial officer at Arbor Realty, said the firm is in a quiet period as it prepares to release its year-end results later in February. He said the firm has been consistent and transparent in its messaging over the last several quarters and remains comfortable with its public statements and market guidance. He said the firm looks forward to updating the public with its year-end earnings release.

Boom and Bust of Apartment Housing Loans

The apartment housing sector was one of the most attractive commercial real estate market segments during the pandemic, as it benefited from the high demand for rental housing and the low interest rates. Many lenders and investors rushed to lend to apartment complexes and bundle those loans into CLOs, which offered higher returns than other fixed-income products.

According to data compiled by Bloomberg, the dollar value of loans bundled into new CRE CLOs, including apartment buildings, surged from $19 billion in 2019 to $45 billion in 2021. The share of loans late to make payments across the vehicles plumbed lows around 1-3% from 2021 to 2023, according to the data compiled by Santander.

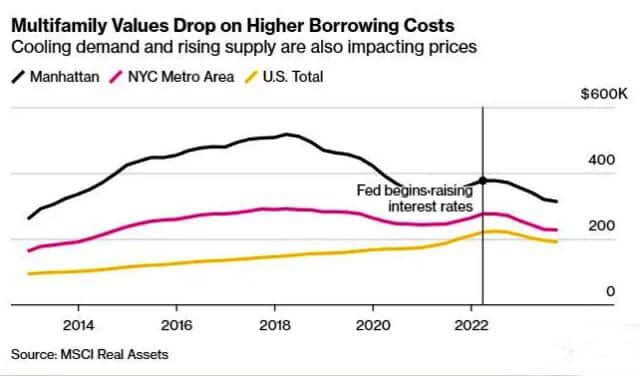

However, that trend stopped when borrowing rates began to rise in 2023. New supply, slowing revenue growth and higher expenses also added to the pain, with the multifamily delinquency rate for commercial mortgage-backed securities expected to double this year to 1.3%, Fitch Ratings forecasts.

More than $20 billion of apartment complexes purchased in the past three years are potentially distressed, according to MSCI Real Assets, a financial data provider—this figure more than triples when including buildings that haven’t changed hands recently.

“Owners who made purchases at record-high prices may have found their assets landing on servicer watchlists as assumptions used to underwrite their acquisitions proved over-optimistic,” MSCI Real Assets said in a report last month.

Blackstone Inc., one of the largest real estate investors in the world, is meanwhile weighing adding more multifamily assets amid the emerging problems as it sees opportunities to buy distressed properties at discounted prices.

“It’s possible you could see us invest into the weakness in multifamily because we’ve got a long-term constructive view, even if there are some near-term headwinds,” Jonathan Grey, the CEO of the company, told analysts last month on a call.

Still, the MSCI Real Assets report says that the number of new possible problems in apartment complex rentals has decreased over the past few months as the outlook for borrowing costs gets better. According to traders, rates could go down up to six times this year, which is good news for renters.

At least two short seller reports have been published on Arbour, based in Uniondale, New York. Viceroy Research published one in November, stating that Arbour is overloaded with troubled loans.

According to figures put together by S&P Global, almost 31% of people were shorting the company on Wednesday. Short sellers borrow stock and then sell it in the hope that they can make money by getting it back later at a lower price.

An investor presentation released in May said Arbour owed about $7.3 billion in collateralized loan obligations last year, almost half of its total capital.