Iran and the U.S. remain targeting each other following the killing of Iranian top general Qasem Soleimani, leaving some analysts questioning if the situation between the two countries would lead to war.

Official respondents from both sides have conveyed they’re not looking for an all-out war at the time. While seeing what’s happening between these two relatively aggressive countries, various geographical experts from the U.S. and worldwide predicted that Iran – more than the U.S. – cannot afford to get involved in a war. That’s partly due to the weakened economy of the Islamic state.

The years of punishing sanctions by the U.S. government have made it fairly difficult for Iran to get drawn into an armed conflict with one of the world’s powers, which is superior both financially and militarily.

Discussions have been mounting over Iran’s economic conditions in coming times. To be precise, updated data on Iran’s financial condition isn’t readily available from official resources. Here, we’re sharing six charts that help us understand the current state of the Iranian economy.

Recession in the Economy

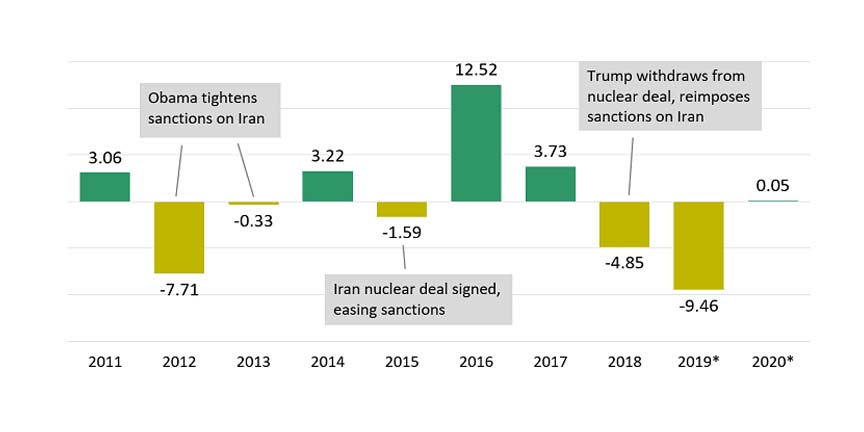

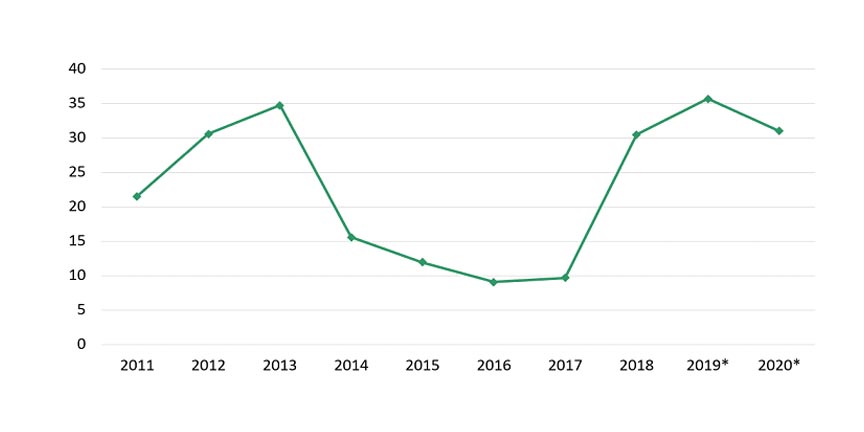

The chart below shows Iran’s yearly economic conditions following the international sanctions intended to prohibit Iran from pursuing its nuclear program.

Source: International Monetary Fund (IMF) October 2019, multiple news sources. 2019 and 2020 figures are IMF forecasts.

Iran received relief from some sanctions when it accepted a deal with six major powers in 2015 to curb its nuclear activity. However, in 2018, President Donald Trump revised U.S. sanctions on Iran, again directing the economy down the line.

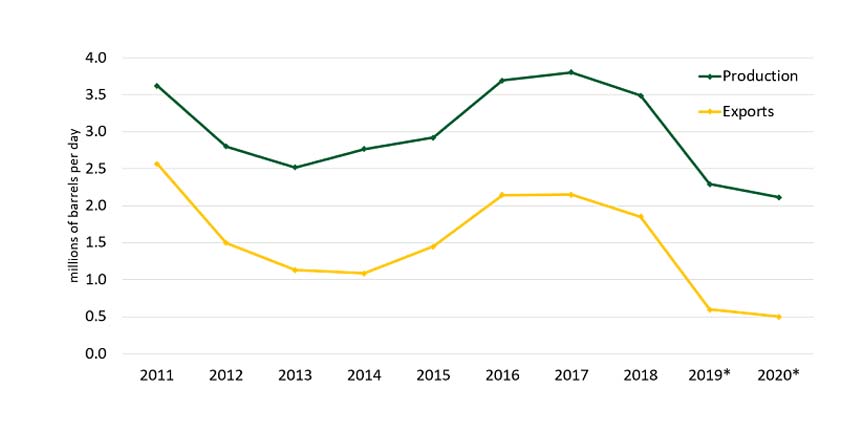

Decline in the Oil Industry

Even though Iran has the world’s fourth-largest reserves of crude oil, the country remains low both in the production and exports of crude oil, following the restrictions that Trump reinstated two years ago on the sale of Iranian oil.

Source: International Monetary Fund (IMF) October 2019 and 2020 figures.

These restrictions have been the primary reason analysts – including the International Fund – expect the production and exportation of Iranian oil to decline. This will directly affect the country’s economic growth, as much of its revenues depend on the sale of crude oil.

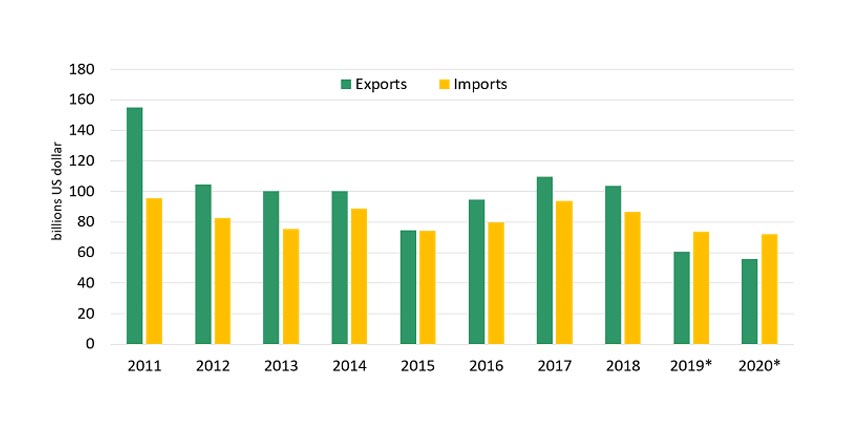

Shrinking Trade

Restrictions on Iran are finding their way to all the other sectors, including mining, banking and maritime, and this has caused the country’s overall trade to decrease significantly.

The IMF recently reported Iran’s exports could drop below its imports during 2019 and 2020.

Rising Costs of Living

The Central Bank of Iran maintains an almost steady official exchange rate of 42,000 Iranian rials per U.S. dollar. Unluckily, the currency seems much weaker than that in the unofficial market, penetrating to as much as 140,000 rials per dollar this month following a heightened conflict with the U.S., as told by a foreign exchange website Bonbast.com.

Consequences started to take place a long ago; the recent escalation with the U.S. contributed to even higher inflation levels across the country.

Source: IMF (October 2019), Central Bank of Iran.

According to a World Bank report, spiralling prices in Iran peaked at 52% in May 2019, raising the costs of living when job markets are lacking.

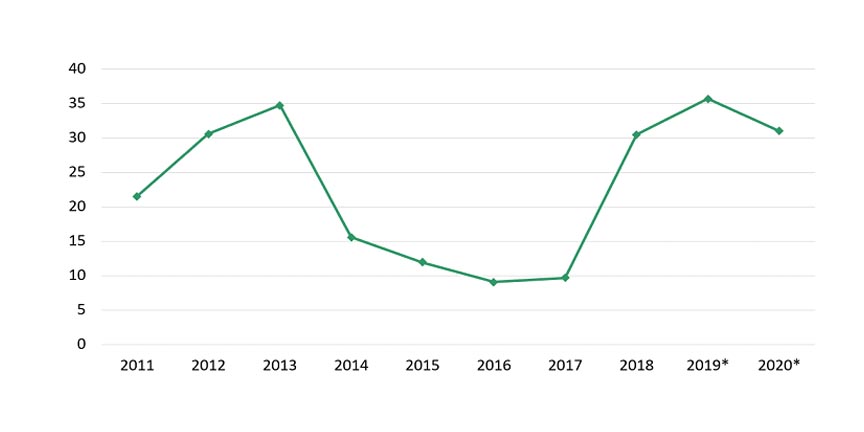

Escalating Unemployment Rate

One principal implication of a stagnant or declining economy is an increasing unemployment rate, which has been seen in Iran.

Source: International Monetary Fund (October 2019), National Statistics Office of Iran.

The near absence of employment opportunities can worsen poverty in Iran, says the World Bank. It noted that the country’s poverty level, measured by the proportion of the public whose purchasing power is under $5.50 a day, had skyrocketed from 8.1% in 2013 to 11.6% in 2016.

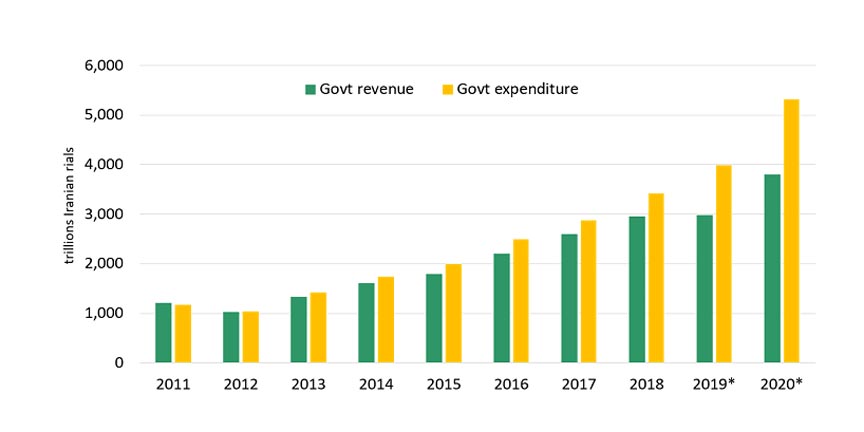

Widening Fiscal Deficit

Exacerbated by restrictions on oil sales overseas and an overall subdued economy, the Iranian government has found limited finances to roll out measures to lift their economy.

Source: International Monetary Fund (October 2019), Finance Ministry of Iran.

Now – in the presence of such fiscal constraints – it can be challenging for Iran to fund a war against the U.S. However, experts said Tehran could still ramp up its aggression against the U.S. by making use of its proxy forces present across the Middle East, stretching from Yemen and Syria to Afghanistan.