Key Points:

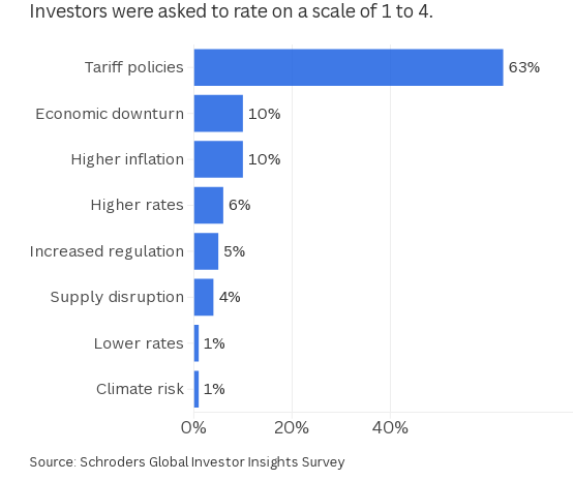

- Nearly two-thirds (63%) of investors view tariffs as the most considerable macroeconomic risk, according to a Schroders survey, which outpaces other concerns by over six times.

- U.S. tariffs, including a 25% tax on Mexico and Canada and a 10% tax on China, have sparked market swings, according to Reuters.

- Investors fear inflation and recession risks, with J.P. Morgan reducing its 2025 U.S. GDP growth forecast to 1.6%.

A Schroders survey released June 12, 2025, found that 63% of institutional investors and wealth managers view tariffs as their top macroeconomic worry.

The poll, conducted in April and May 2025, surveyed nearly 1,000 investors managing $67 trillion in assets. Tariffs outranked other risks, such as inflation or geopolitics, by over six times, according to CNBC.

Conducted before the U.S.-China trade deal was announced on June 11, 2025, the survey reflects concerns about potential trade wars. The deal, awaiting approval from President Donald Trump and Xi Jinping, aims to lower tariffs by 55% and ease tensions, according to posts on X.

Market Volatility and Trade Deal

President Trump’s tariff policies, including a 25% tariff on Mexican and Canadian imports and a 10% tariff on Chinese goods, roiled markets. The S&P 500 declined 12% from its February 2025 peak, according to Reuters.

A 90-day tariff pause on Mexico and Canada spurred a 9.5% rebound in the S&P 500 on April 9, 2025, but volatility persists, with the VIX index at its 2023 highs.

The U.S.-China deal, which reduces tariffs and secures rare earth supplies, has calmed some fears, according to a post by @dailyupdates04. However, J.P. Morgan warns tariffs still pose inflationary risks, cutting 2025 U.S. GDP growth to 1.6%.

The survey shows that 80% of investors plan to increase actively managed investments to navigate volatility.

“Resilience now tops the investment agenda,” said Johanna Kyrklund, Schroders’ chief investment officer. “Markets are adjusting to higher interest rates and debt burdens.” She noted passive strategies struggle in uncertain times, while active management offers control.

Investors are eyeing tariff-proof assets, such as gold, which hit record highs in 2022, according to the CFA Institute. On X, @MacroInsight360 noted markets temporarily shrugged off tariff risks, expecting Trump’s pause to hold.

Tariffs fuel inflation fears, with 70% of Americans believing they’ll raise prices, per an ABC News poll. Disapproval of Trump’s tariff handling is 64%, including 25% of Republicans. Investors are concerned about recession risks, with Goldman Sachs increasing its odds of a U.S. recession to 35%.

The European Commission estimates that U.S. tariffs could shrink EU GDP, with retaliatory measures exacerbating the impacts. X user @macroymercados highlighted the Schroders findings, reflecting investor anxiety.

The U.S.-China deal may ease tensions, but investors remain cautious. Thomson Reuters reports that companies are using technology to diversify their supply chains. J.P. Morgan notes that tariff uncertainty curbs capital spending, which in turn drags down exports. On X, @SGMFX praised the trade deal for securing rare earths, but @HenriettaVeda called talks “treading water.” With the Federal Reserve holding rates at 4.25%-4.5%, per Reuters, investors seek resilience amid trade and inflation risks.